Hear from guest blogger, Amanda Clark, on what SMS marketing can do for your e-commerce.

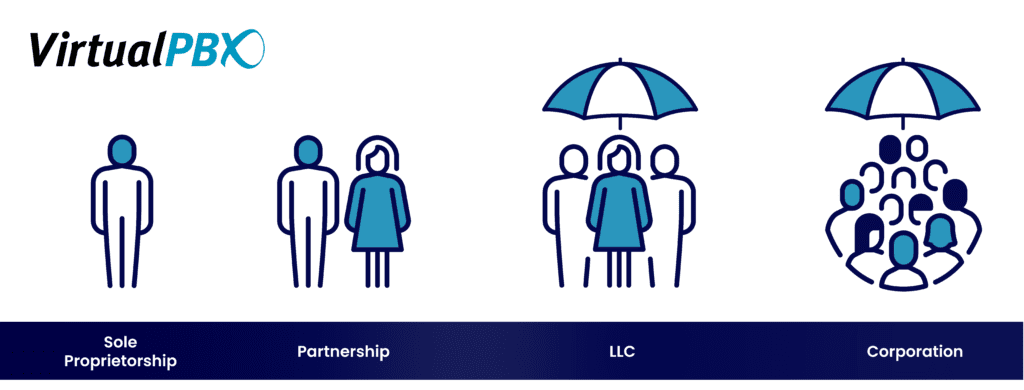

When you start a new business, you’re faced with a number of critical decisions. Few of these decisions matter more over the long run than your decision about which legal formation to choose. The legal formation you choose for your business can affect virtually all aspects of your business, from how you report to the IRS to how you bring new employees on board.

Because this decision is so paramount, it’s helpful for business owners to have a clear understanding of the different options available to them and to understand the specific pros and cons of each.

Sole Proprietorship

Sole Proprietorship Pros and cons

- Ease Of Setup

- Very Light Regulatory Burden

- Total Control

- Pass-Through Taxation / No Double Taxation

- Sole Decision Making Ability Without Consulting A Partner or Board of Directors

- Unlimited Liability / Significant Risk Exposure, Especially In Litigious Environments

- Limited Capital

- High Responsibility

- Challenges Bringing On New Employees

- Difficulty Selling or Passing Along A Business

Partnership

Partnership Pros and cons

- Ease Of Setup

- Very Light Regulatory Burden

- Pass-Through Taxation / No Double Taxation

- Shared Workload And Decision Making

- Unlimited Liability / Significant Risk Exposure, Especially In Litigious Environments

- Difficulty Selling or Passing Along A Business

- High Potential For Partner Disputes

Limited Liability Company (LLC)

The Limited Liability Company, or LLC, is generally regarded as the most popular and versatile legal formation for small businesses. In many ways, it represents the best of both worlds: A chance to combine the flexibility and ease of a sole proprietorship with some of the robust personal liability protections associated with corporations (more on that shortly).

The big distinction between an LLC and a sole proprietorship (or a partnership) is that an LLC actually creates a new legal entity, one that is distinct from its owners. In other words, you can keep business assets and liabilities separate from personal ones. If you’re hit with litigation, you can keep your business interests and your personal interests separate. You can more easily recruit employees and even transfer ownership of the LLC, including as part of a succession plan.

The specifics for registering an LLC can vary by state, but as a rule of thumb, business owners will need to attend to the following steps:

- Choose a state to register in.

- Ensure an LLC name that isn’t already claimed by another LLC in the same state.

- Appoint a registered agentwho has a mailing address in the same state (e.g., for an LLC in Texas, you’ll need an agent with a Texas address).

- File articles of organization with your state, and pay the state’s registration fee.

- Create an operating agreement to outline how you’ll operate your LLC.

- Claim an Employer Identification Number (EIN) from the IRS.

LLC Pros and cons

- Substantial Legal Liability Protections

- Ability To Sell Shares And Bring In Investors

- Shared Responsibilities And Decision-Making

- Professional Credibility

- Significant Regulatory Hurdles

- More Work And Expense to Create And Maintain

- Double Taxation For Most Corporations

- Less Financial Privacy And Confidentiality

Corporation

Corporation Pros and cons

- Personal Liability Protection

- Flexible Management

- Pass-Through Taxation

- Professional Credibility

- Greater Access To Funding, Including Business Loans And Lines Of Credit

- Varied Fees And Regulations By State

- Some Costs Associated With LLC Formation

- No Way To Sell Shares To Bring In Investors

Which Formation is Right for You?

As you consider the different legal formations available to your business, remember to consider all aspects of taxation, day-to-day business operation, ability to secure funding, and the level of legal exposure you’ll be taking on. Think also about the sort of regulatory burdens you’re willing to absorb.

In addition to these factors, think about the tools you’ll need to effectively manage and communicate within your business. For example, regardless of the formation you choose, having a reliable business communication solution is crucial. Services like VirtualText and Business Phone service can enhance your communication capabilities, helping you stay connected with clients, partners, and employees efficiently.

With specific questions, don’t hesitate to contact an attorney or a business coach in your area.

About the Author

Amanda E. Clark is a contributing writer to LLC University, a Benefit Company committed to creating economic value in the community through free content and courses to help you form your LLC. She has appeared as a subject matter expert on panels about content and social media marketing, as well as small business ownership.